About Us

Capital Dynamics Asset Management Sdn. Bhd. (389773-H) or CDAM is licensed as a fund manager under the Capital Markets and Services Act of Malaysia. CDAM obtained its licence in 1997 and has been delivering consistently superior returns to its clients.

Setting up CDAM was more than just a logical extension of our operations. It all began in early 1988, when Capital Dynamics Sdn Bhd or CDSB applied for its investment advisory licence. This was soon after the nightmarish crash of October 1987, a time when many were convinced that a global depression was starting. We, instead viewed it as an opportune time to enter the investment industry. In 1989, CDSB became Malaysia’s first independent investment adviser. Its investment portal, www.icapital.biz, was launched in 2002.

In Malaysia, as in other countries, we recognised that there was a dire need for a fund manager that has a “partnership” attitude towards clients; one whose success is unquestionably tied up with the performance of its clients’ portfolios. In building CDAM up as an independent, owner-operated set-up, there really is no doubt that we have put our money where our mouth is. We do well only if our clients do well.

The following passage from the 1940 book, “Where are the customers’ yachts ?” by Fred Schwed sums it all:

“An out-of-town visitor was shown the wonders of the New York financial district. When the party arrived at the Battery, one of his guides indicated some handsome ships riding at anchor.

He said, ‘Look, those are the bankers’ and the brokers’ yachts’.

‘Where are the customers’ yachts ?’ asked the naive visitor.”

Our Track Record

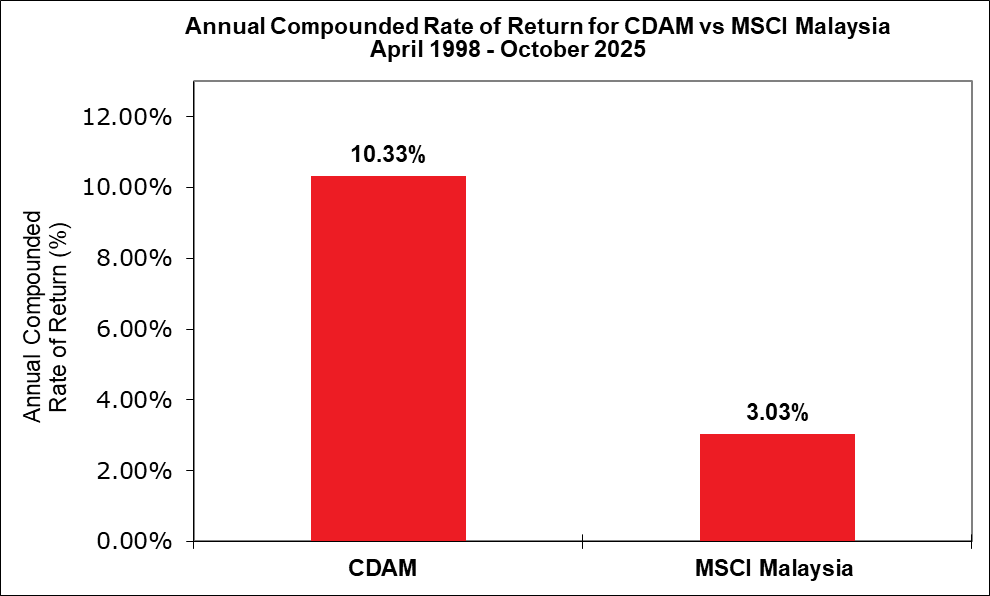

- CDAM has consistently outperformed the MSCI Malaysia since its inception.

- From 27 April 1998 to 31 October 2025, CDAM achieved an impressive compound returns of 10.33% per annum versus a return of 3.03% for the MSCI Malaysia.

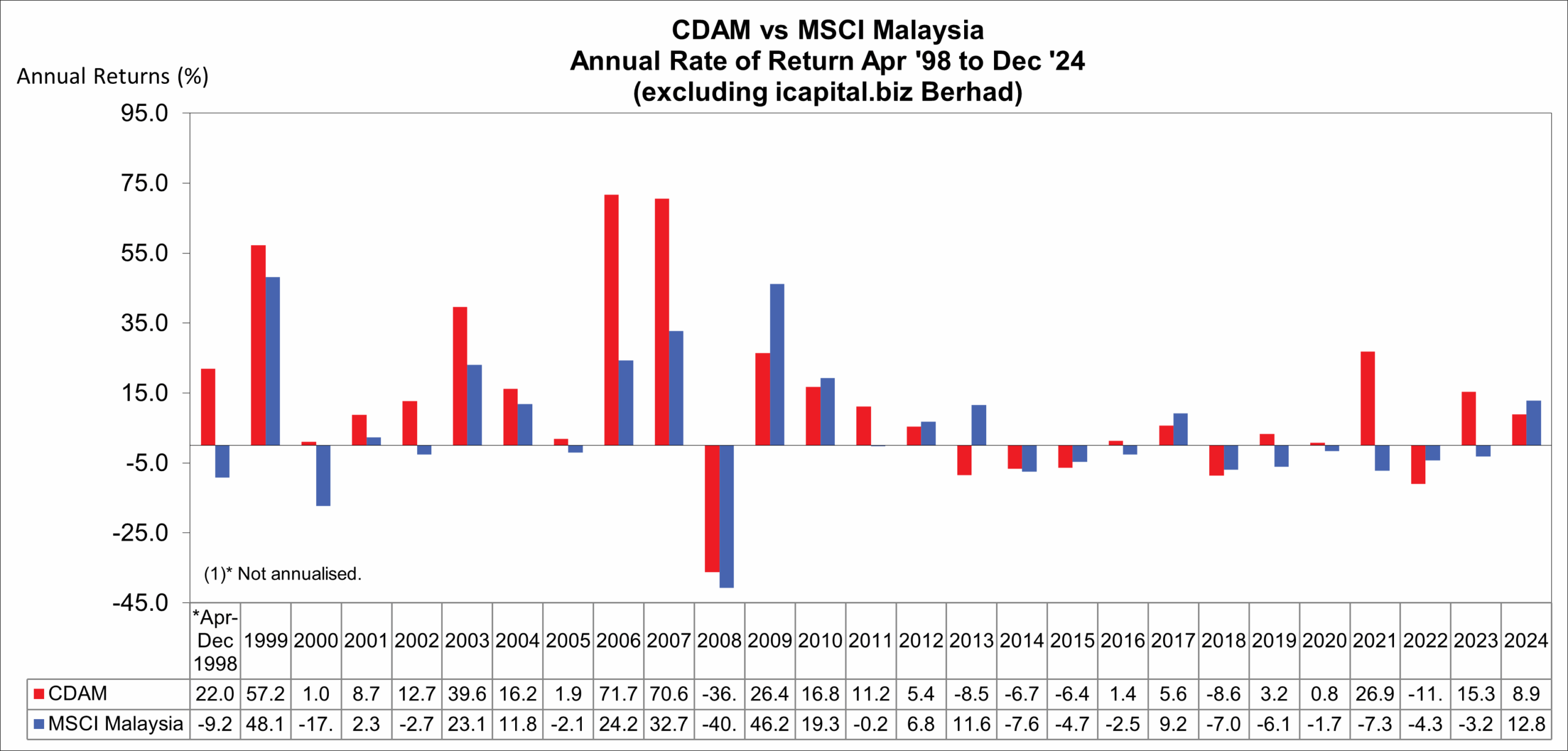

- From 1997 to 2024, CDAM has only recorded six years of negative return in 2008, 2013, 2014, 2015, 2018 and 2022.

CDAM’s clients include individuals, reputable corporations and institutions. Table 1 below shows the latest performance measurement of CDAM and MSCI Malaysia Index.

| CDAM | 10.33% |

|---|---|

| MSCI Malaysia | 3.03% |

Table 1: Annual Compounded Rate of Return (April 1998 – October 2025)

Figure 1: Annual Compounded Rate of Return (April 1998 – October 2025)

During bull markets, all fund managers can perform well. The difference between a good fund manager and a lousy fund manager can only be seen during bear markets. As we all know, you will only know who is swimming naked when the tide goes out as the figure 2 below shows.

Figure 2: Annual Rate of Return (April 1998 – Dec 2024)

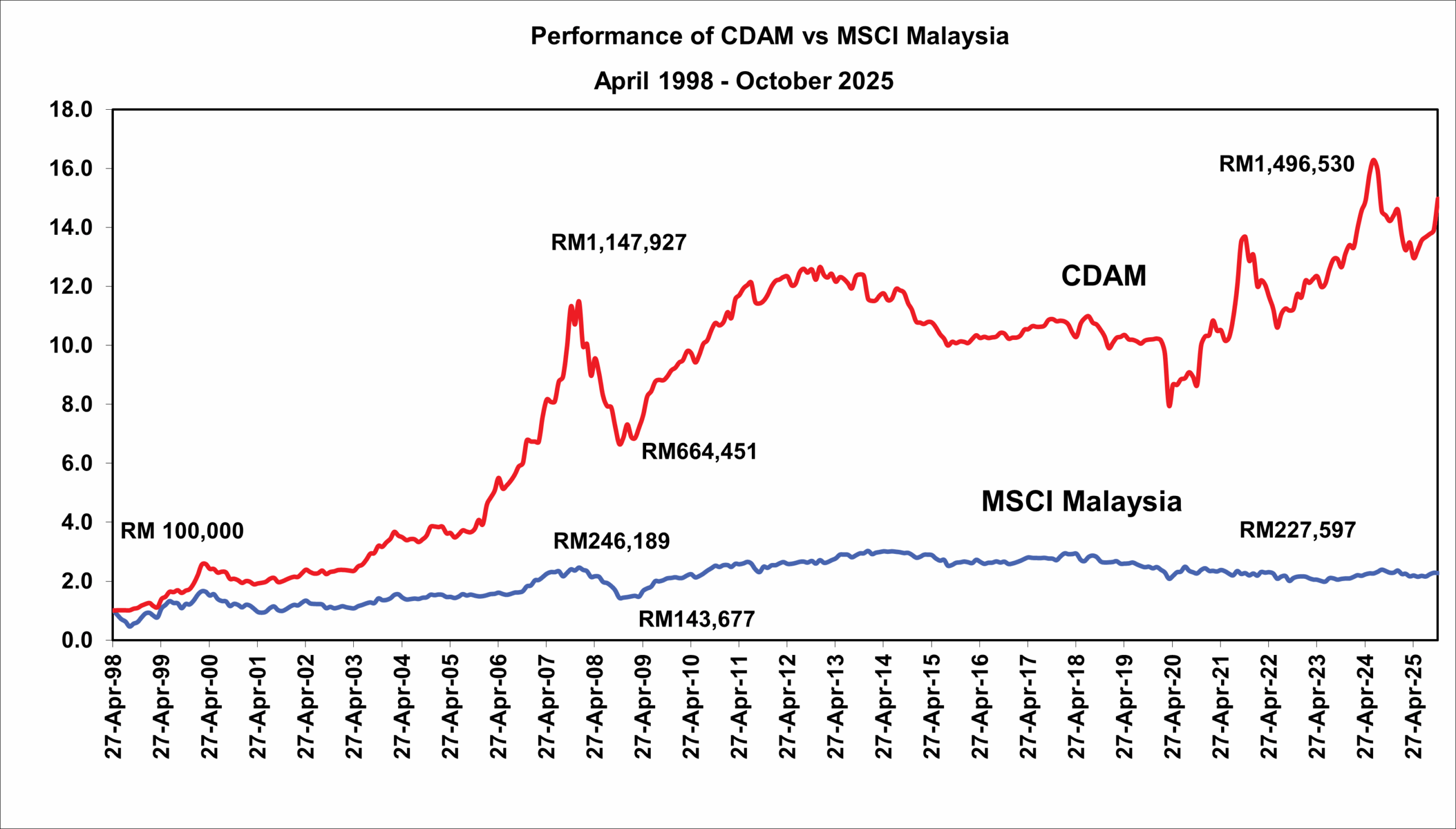

The figure 3 below shows a comparison between the performance of CDAM and MSCI Malaysia from April 1998 to October 2025. If an investor opened an account worth RM100,000 with CDAM in April 1998, by Oct 2025, the investment would have grown to RM 1,496,530. But if the investor had invested RM100,000 in MSCI Malaysia, the investment would have only grown to RM227,597.

Even if the investor invested with CDAM during the peak of the market in early 2000, the returns would be close to 6 times after 25 years. If someone invested in MSCI Malaysia at the said peak, the investment would only be close to 1.5 times.

Figure 3: Performance of CDAM vs MSCI Malaysia (April 1998 – October 2025)

For more information, please contact us at enquiries@cdam.biz.

Disclaimer

The performance of CDAM for the period 27 Apr 1998 to 31 Dec 2016 has been independently verified. The performance of CDAM for the period 1 Jan 2017 to 31 October 2025 is believed to be reliable, but has not been independently verified. Past performance and any forecast are not necessarily indicative of future or likely performance.

Our company’s philosophy can be summed up as Independence, Intelligence and Integrity.

CDAM practises and recognises the importance of “Independence”, “Intelligence”, and “Integrity” in the provision of its fund management services.

Independence of thought and action comes naturally at CDAM. This is because CDAM is not associated with any financial institutions, large corporations or government organisations, thus preventing conflicts of interest. With a clear focus, its efforts are concentrated on providing the best possible fund management service.

CDAM does not act on tips, rumors, hearsay, etc., but only on an intimate knowledge of investments, based on intelligent and objective analysis.

While it sounds abstract, CDAM believes that integrity will, in the long run show in the investment returns that its clients receive.

Anchored on the values of these 3 ‘I’s, CDAM has gradually and successfully built up its recognition and reputation in the investment industry, locally and regionally. The persistent application of the 3 ‘i’s philosophy holds the key to CDAM’s consistent success in the stock market.

| Year | Description |

|---|---|

| Jun 1996 | CDAM was set up. |

| May 1997 | CDAM obtained a fund management licence from the Securities Commission. |

| 27 April 1998 | The first client’s account was opened. The delay in accepting clients was intentional, as CDAM did not feel that the time was right to invest when we got the licence. We did not want to put our clients’ money in fixed deposits and still charge them a management fee. |

| Oct 1998 | The first stock purchase was made. When the Federal Reserve cut interest rate for the second time in 2 months and outside the Federal Open Market Committee meeting, it was our buy signal after watching the world economy very closely. |

| Dec 1998 | We accepted our first corporate client. |

| Apr 1999 | The funds under management reached the first RM10mln. |

| Oct 2003 | The funds under management reached the first RM100mln. |

| Jun 2005 | The SC approved the launch of icapital.biz Bhd, a closed-end fund to be managed by CDAM. |

| Now | In a span of 17 years since we accepted our first client in 1998, the funds under CDAM’s management has surpassed half a billion ringgit and it is still growing. |

1. Mr Tan Teng Boo

Mr Tan Teng Boo is the Managing Director of CDAM.

He is also the Designated Person of icapital.biz Berhad, a closed-end fund listed on Bursa Malaysia Securities Berhad since October 2005.

Mr Tan is a Fund Manager and holds the Capital Markets Services Representative’s Licence Holder for the regulated activity of Fund Management. He has over four decades of experience in the capital markets. He holds an honours degree in Economics from Sussex University, England.

Mr Tan is also an adjunct professor at the University of Technology Sydney (UTS) and Industry Fellow of UTS Business School.

2. Dato’ Dr Tunku Sara Binti Tunku Ahmad Yahaya

Dato’ Dr Tunku Sara Binti Tunku Ahmad Yahaya was appointed as Non-Independent Non-Executive Director of CDAM on 20 April 2020. She was redesignated as Independent Non-Executive Director in June 2025. Dato’ Dr Tunku Sara Binti Tunku Ahmad Yahaya is a medical specialist by training. She is an Honorary Professor at the University of Malaya (UM) and Director of the National Orthopaedic Centre of Excellence in Research and Learning (NOCERAL) at the Faculty of Medicine, UM.

She graduated from the Royal Free Hospital School of Medicine, University of London in United Kingdom in 1982 and further pursued her Fellowship of the Royal College of Surgeons (FRCS Glasglow) qualification in 1998.

Dato’ Dr Tunku Sara Binti Tunku Ahmad Yahaya started her career as a Consultant Orthopaedic Surgeon and an academic staff of University Malaya, Malaysia’s premier university since 1984. She was the Head of the Orthopaedic Surgery Department, Faculty of Medicine, University Malaya from 1999 to 2012. Dato’ Dr Tunku Sara Binti Tunku Ahmad Yahaya was appointed as the Head of Unit for the upper limb and reconstructive microsurgery since 2000. She is a registered Specialist in Orthopaedic Surgery under the National Specialist Register.

Dato’ Dr Tunku Sara Binti Tunku Ahmad Yahaya has co-authored numerous medical journals and has been active in providing consultancy for research/ innovative projects, clinical trials within her area of expertise.

3. Mr Tan Yuen-Lin

Mr Tan Yuen-Lin was appointed as Non-Independent Non-Executive Director of CDAM on 9 April 2013. He obtained a Bachelor of Science in Computer Science with a minor in English from Carnegie Mellon University in 2004, and a Master of Arts in Buddhist Classics from Dharma Realm Buddhist University in 2017.

Mr Tan Yuen-Lin started his career with VMware Inc. in June 2004. At VMware, he served as a Senior Member of Technical Staff. In October 2008, he joined VSee Lab Inc. where he eventually served as Director of Engineering until July 2015. He served as the Associate Dean of Campus Life at Dharma Realm Buddhist University from 2018 to 2024.

He is the son of Mr Tan Teng Boo.

4. Ms Tan Mun Lin

Ms Tan Mun Lin was appointed to the Board of Directors on 15 June 2017.

Ms Tan currently serves as Executive Director and Fund Manager (CEO’s Office) and holds a Capital Markets Services Representative’s Licence for the regulated activity of Fund Management.

Ms Tan started her career in Capital Dynamics Sdn Bhd as Executive Assistant to CEO (Investment Research) in September 2009. She assisted the CEO in local and global research and analysis, besides supporting the CEO in supervising and managing the research team.

Ms Tan graduated from the University of Sydney with a Bachelor of Commerce (Major in Finance) in 2007 and a Bachelor of Laws in 2009.

5. Mr Yip Kit Weng

Mr Yip Kit Weng graduated with a degree in Accounting and Finance from the University of Western Australia in 1993. He has approximately over thirty (30) years of experience in equity fundraising, corporate finance and advisory services, corporate banking, private debt securities issuances and private equity transactions.

He currently serves as an Independent Non-Executive Director of Supermax Corporation Berhad, Euro Holdings Berhad, Privasia Technologies Berhad (Listed on Bursa Malaysia Securities Berhad) and as Independent Non-Executive Chairman of InFocus Group Holdings Limited (Listed on the Australian Stock Exchange).

Mr Yip started his career in 1993 with Messrs PriceWaterhouseCoopers before joining Utama Merchant Bank Bhd as Senior Manager, Corporate Finance. Prior to being appointed as Deputy Group Managing Director of Affin-Hwang Investment Bank Berhad from October 2019 to November 2021, he served as Executive Director, Head of Investment Banking, Nomura Securities Malaysia Sdn Bhd (July 2014 to September 2019), Director of Corporate and Investment Banking Services, RHB Investment Bank Berhad (August 2013 to June 2014) and as Director of Equity Capital Markets, CIMB Investment Bank Berhad (February 2010 to August 2013).

He is a fellow member of Chartered Tax Institute of Malaysia (CTIM), Chartered Accountant of the Malaysian Institute of Accountants (MIA), a Certified Financial Planner of Financial Planning Association of Malaysia (FPAM) and is also a Fellow Member of CPA Australia (FCPA). In addition, Mr Yip serves as President of CPA Australia Malaysia Division (2025 to 2026).

Mr Yip also serves as an Industry Advisory Panel member for the Faculty of Business of Curtin University Malaysia, for the period 2023 to 2026.

6. Ms Hew Mei Ying

Ms Hew Mei Ying was appointed as Independent Non-Executive Director of CDAM on 1 August 2024.

Ms Hew, who holds a Master’s in Business Administration (Finance) from the University of Southern Queensland, Australia, is currently the Chief Financial Officer of HeveaBoard Berhad. She brings over thirty (30) years of experience in the manufacturing environment with publicly listed/multinational companies, including a significant tenure as Senior Finance Manager at Samsung SDI (M) Berhad.

She is a fellow member of the Chartered Institute of Management Accounts (CIMA), a member of the Australia Certified Practising Accountant (CPA Australia) and a Chartered Accountant (CA) of the Malaysian Institute of Accountants (MIA).